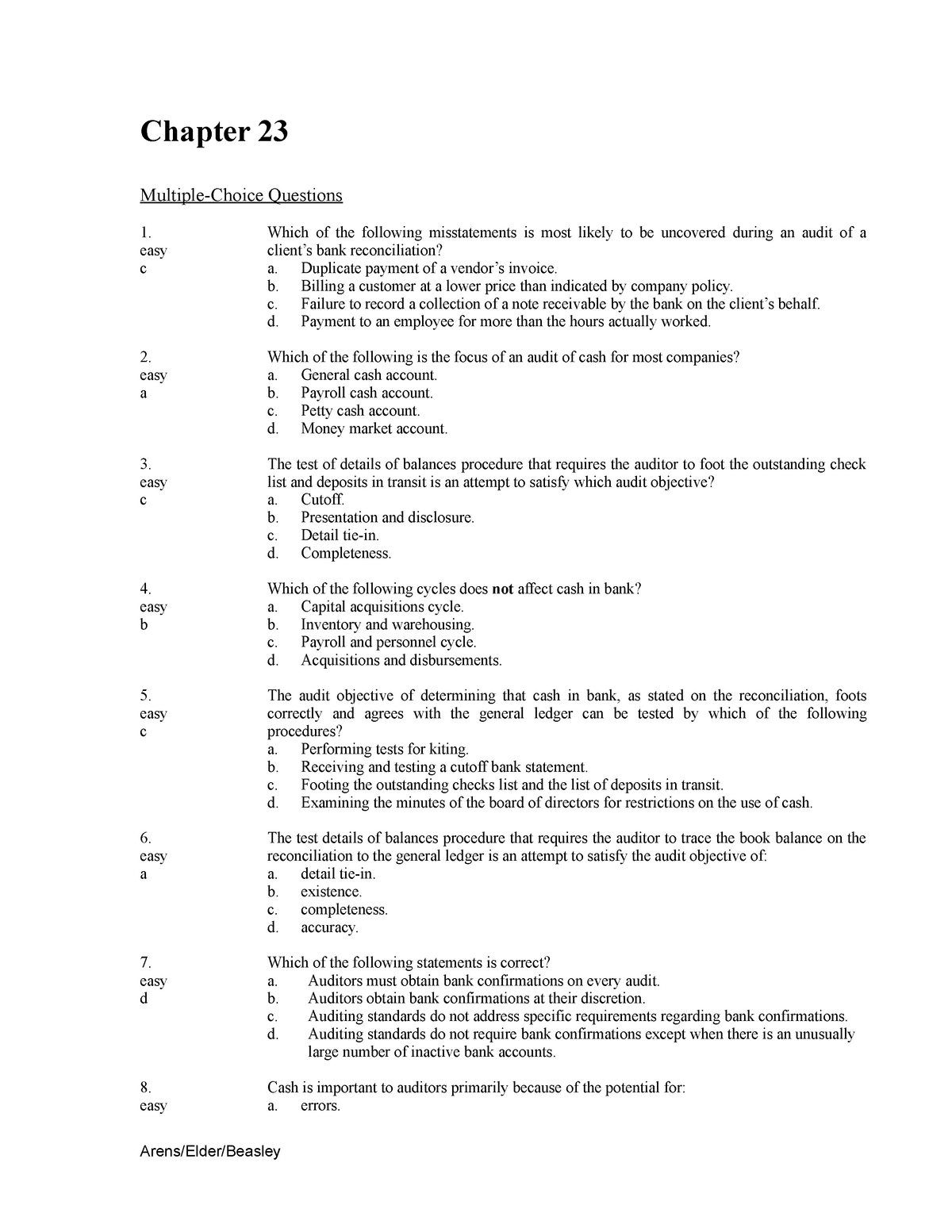

1 Which of the Following Checks Might Indicate Kiting

Low average balance compared to high level of deposits. The check was recorded as a deposit in the State account on December 31 but was not recorded as a disbursement in the County account until after year end.

1st Asynchronous Drill Answers Pdf Cheque Balance Sheet

Postdated checks that are payable to the company.

. Are dated and issued on December 30 2013. 101 and 303 b. Step 1 of 5.

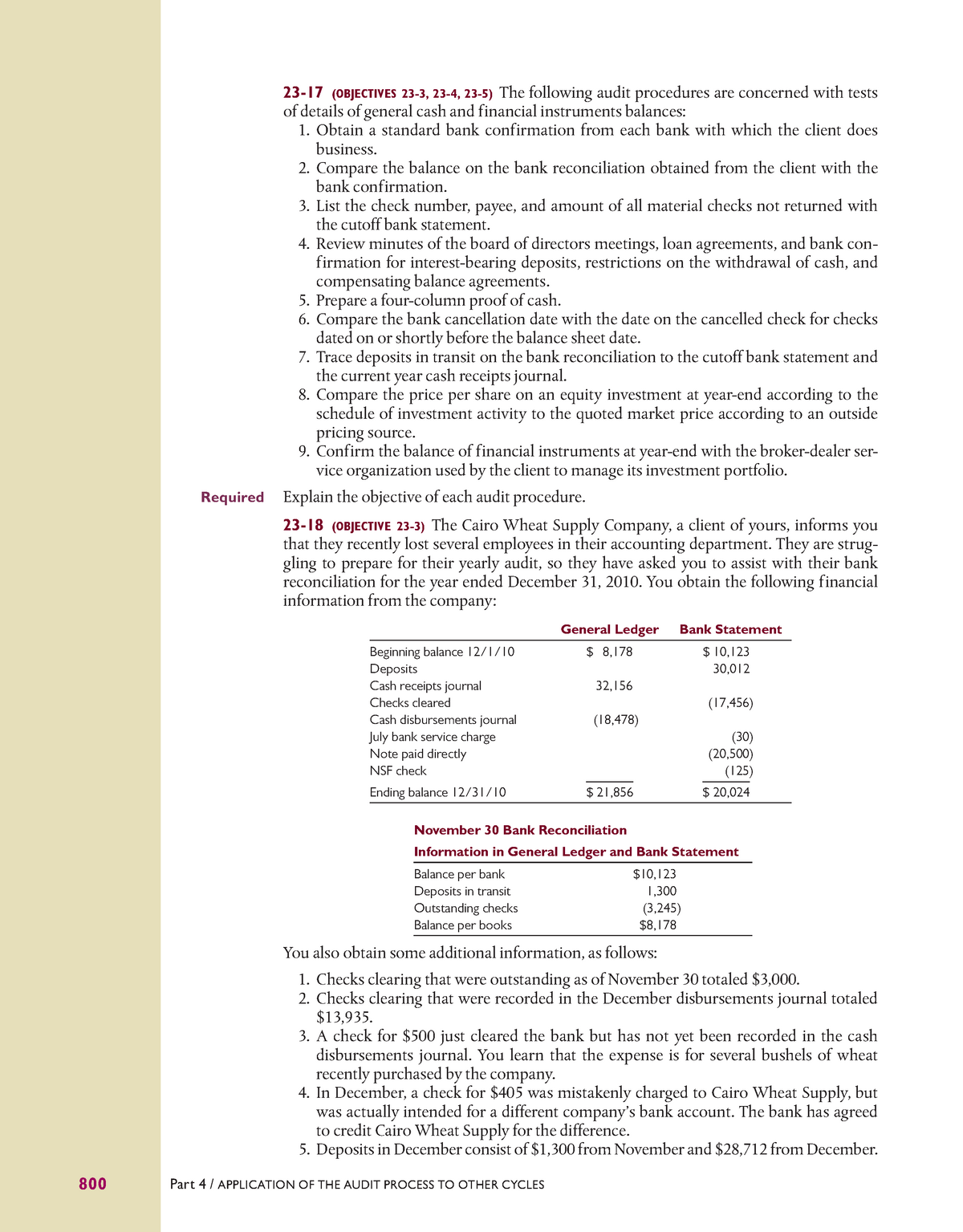

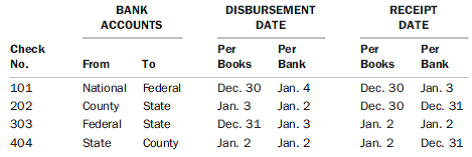

Prepare a schedule of bank transfers. A bank can monitor several check kiting indicators which give it immediate notice that there is an ongoing check kiting scheme. Unit 4 Problem 2 Proof of cash The following information was obtained in an audit of the cash account of Tuck Company as of December 31.

Kiting is the fraudulent use of a financial instrument such as a check to obtain additional credit that is not authorized. He then writes a check on that account for a large sum such as 50000. 101 and 303 b.

202 and 404 c. 101 and 102 c. Choice d is incorrect.

202 and 404 c. Which of the following checks might indicate kiting. Which of the following characteristics most likely would be indicative of check kiting.

A large proportion of cash in an account that has not yet cleared the paying bank. The check kiter opens an account at Bank A with a nominal deposit. Kiting might be uncovered by the following audit procedures.

These indicators are as follows. An auditor is concerned about the possibility of fraud if. Many checks are drawn on the same bank.

Reconciling Bank A as of year end and Bank B at the end of the first week following year end. An auditor will most likely detect kiting by. How might auditors detect kiting.

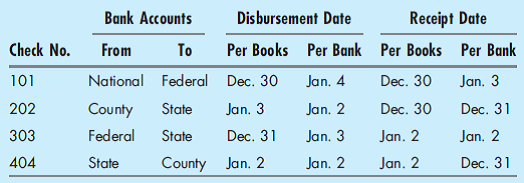

Undelivered checks written and signed by the company. The information below was taken from the bank transfer schedule prepared during the audit of Fox Cos financial statements for the year ended December 31 20X1. A fraud auditor should test bank transfers for the last part of the audit period and first part of the subsequent period to detect whether a.

202 and 404 c. Date Amount Disbursement Receipt of Date Bank Accounts Check. Checks 202 and 404 both.

101 and 104 b. The amount reported as Cash on a com panys statement of financial position normall y. Bank Accounts Disbursement Date Receipt Date.

101 and 103 c. Kiting is a technique that might be used. High turnover of employees who have access to cash.

LO 8 The following information was taken from the bank transfer schedule prepared during the audit of Fox Cos financial state- ments for the year ended December 31 2013. 101 and 303 b. Frequent ATM checking account withdrawals.

Kiting may also take place within the one entity where the entity has more than one bank account. A check kiting scheme operates as follows. Which of the following checks illustrate depositstransfers in transit at December 31 2005.

What is check kiting. 202 and 303 202 and 404 101 and 303. 1As a surprise count of cash and customers checks on hand is made as a test for lapping determine that checks representing transfers of funds are properly recorded on the books.

Cash in a payroll account. Prepare year-end bank reconciliation. 101 and 404 d.

In the reconciliation for the three bank accounts indicate the check numbers that should appear as 1 an outstanding check or 2 a deposit in transit. Assume all checks are dated and issued on December 30 20X1. 101 and 103 d.

102 and 104 d. In the reconciliation for the three bank accounts indicate the check numbers that should appear as 1 an outstanding check or 2 a deposit in transit. 1 point An auditor decides to use the blank form of accounts receivable confirmation rather than the traditional positive form.

An unrecorded check issued during the last week of the year would most likely be discovered by the auditor when a. The check kiter then opens an. All of the above.

An auditor would most likely detect kiting by reviewing the bank transfer schedule and following-up on all transfers for which the receipt date per bank is recorded in the accounting period before the disbursement date. Indicators of Check Kiting. Prepare a bank transfer schedule as of June 30 using the following layout.

Which of the following checks might indicate kiting. Choice C is correct. The auditor should be aware that the blank form may be less efficient because.

Which checks may be indicative of kiting. Which of the following checks might indicate kiting. Confirmations are essential to detecting kiting schemes.

For each of the following indicate whether the item would be reported on the balance sheet. AUD Kitting Question. A large number of check deposits each day.

2000 counts of mail and wire fraud that involved a check kiting 1. Review the composition of authenticated deposit slips. This topic has 4 replies 3 voices and was last updated 3 years 5 months ago by watermelon.

Review subsequent bank statements received directly from the banks. Check out a sample QA here. Kiting occurs when a check drawn on one bank is deposited in another bank and no record is made of the disbursement in the balance of the first bank.

There are two variants of kiting. Which of the following is one of the better auditing techniques that might be used by an auditor to detect kiting. 102 and 104 b.

Cash receipts net of the amounts used to pay petty cash-type expenditures are deposited in the bank daily b. In the Bank transfer schedule provided the transfer of check number 202 recorded as a deposit receipt on December 30 is an example of kiting. Completing an analysis of interbank transfers and obtaining cutoff bank statements directly from all.

Which checks may be indicative of kiting. Preparing an interbank transfer schedule b. 202 and 404 9 9.

An auditor would most likely detect kiting by reviewing the bank transfer schedule and following-up on all transfers for which the receipt date per bank is recorded in the accounting period before the disbursement date. 101 and 404 d. Frequent kiting may result in a high level of deposits coupled with a low average balance.

The monthly bank statement. Checks 202 and 404 both meet this criterion and therefore might indicate kiting. A practical and effective audit procedure for the detection of lapping is.

101 and 404 d. Which of the following checks might indicate kiting. Confirmations provide information about deposits in transit that is useful in proving the clients year-end bank reconciliation.

The cash receipts journal was held open for a few days after year-end. Reconciling all bank accounts as of year end. Which of the following checks might indicate kiting.

Many large checks that are recorded on Mondays. Want to see the full answer.

Pin On Movie Reviews On Half Measures Podcast

3 Simple Ways To Prove Check Kiting Wikihow

Chapter 23 Resume Audit 2 23 Chapter 23 Questions 1 Easy C Which Of The Following Studocu

Audit Ing And Assurance Services An Integrated Approach Sixteenth Edition Ge 2017 Split Pdf Studocu

Kecurangan Pengendalian Internal Dan Kas

My Best Summer Memories Are In Santa Fe 3 New Mexico Tourism Hotel Santa Fe Taos New Mexico

Example Check Kiting Auditing And Attestation Cpa Exam Youtube

Duotone Spirit Gt ᐅ Your High Performance Freeride Foil

Solved The Following Information Was Taken From The Bank Transfer Chegg Com

Solved The Following Information Was Taken From The Bank Transfer Chegg Com

Semi Final 2 2 Docx Semi Final 2 Brain Battle 1 Perpajakan Hitungan Kategori Hard Delvin Adalah Seorang Direktur Pt Bunda Dengan Penghasilan Course Hero

Which Of The Following Checks Might Indicate Kiting

Comments

Post a Comment